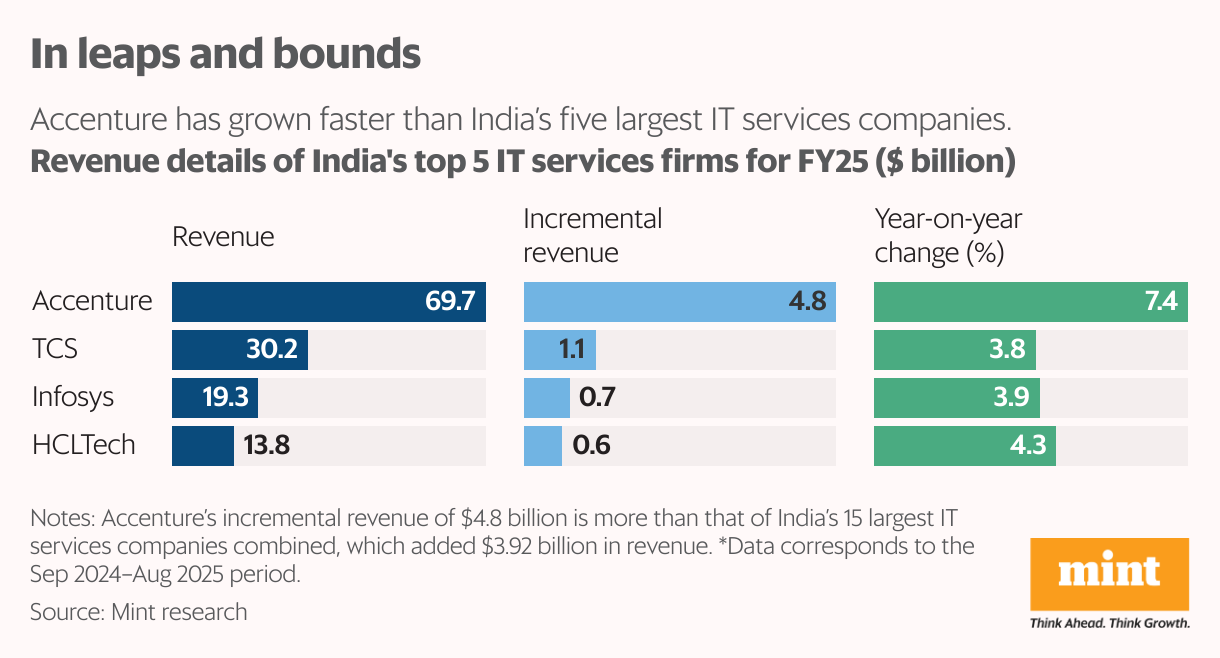

Accenture’s $4.8 billion blitz leaves Indian IT giants trailing far behind

In other words, while the Indian IT cohort is struggling to find its footing in the new digital reality, punctuated by artificial intelligence (AI), Accenture is powering ahead. It simply makes Indian IT’s growth story seem rather tepid.

So, what explains Accenture’s eyebrow-raising performance? The short answer is its pivot to the new, to AI. Indeed, its quarterly presentation on 25 September, dedicated two slides to this “re-invention”. Over half ($2.7 billion) of Accenture’s new revenue came from ‘advanced AI’ solutions. The company also claims that its advanced AI bookings totalled $5.9 billion.

Advanced AI includes generative (Gen) AI, agentic AI and physical AI, or tools interacting with the physical world. They do not include data, classical AI (foundational machine learning and analytics), or AI used in the delivery of services, Julie Sweet, chair and chief executive of Accenture, had clarified earlier.

Understanding Accenture’s approach requires examining how it built its AI story—and where Indian IT missed the trick to load up on its outsourcing gravy train.

Foresight vs hindsight

The $4.78 billion chasm isn’t merely a result of smart salesmanship; it’s the payoff for four years of strategic foresight.

Accenture started with the basics.

As early as 2019—long before the pandemic and the Gen AI explosion—Accenture began requiring its entire workforce of nearly 700,000 people to complete mandatory AI training. By the time the Gen AI wave hit in 2023, Accenture was ready to ride it.

“By the way, since 2019, we have been requiring all of our 700,000 people to take a course on AI,” Sweet had mentioned in a post-earnings call on 22 June 2023.

Most homegrown IT firms, in contrast, started training or re-skilling their engineers only in 2023. Accenture, therefore, had a four-year head start.

Meanwhile, Indian market watchers, analysts and investors, sold on the traditional outsourcing money machine, did not exert much pressure on the management of IT majors like TCS and Infosys.

Sample this: When Accenture first disclosed in June 2023 that it had won $100 million of Gen AI-related orders, eight of the 15 questions to the management in the post-results earnings call were on GenAI, according to Mint’s review.

Only one question in TCS’ post-results earnings call in May that year was on GenAI. Infosys chief executive officer (CEO) Salil Parekh, or his senior management team, received zero questions that quarter.

Indian majors, nonetheless, have woken up and are suddenly racing to train hundreds of thousands of their employees in an effort to play catch up.

Last fiscal, TCS said that more than 100,000 employees, or about a sixth of its workforce, acquired higher order skills in AI/ML and GenAI. More than 270,000 Infosys employees, about four-fifths of its workforce, were trained in using AI tools. At HCL, the company trained 106,000 employees in AI, whereas 87,830 Wipro associates acquired advanced AI skills. HCL and Wipro ended last year with 223,420 and 233,346 employees, respectively.

The $23 billion blueprint

Nonetheless, training staff in new technology is just one part of the process; companies must also develop solution offerings to sell to large clients.

For almost a decade, Accenture, a portmanteau of “accent on the future,” built a business by offering services in the areas generally classified as social, mobile, analytics and cloud (SMAC). Accenture’s entire thesis rests on the premise that the twin pillars of cloud and data analytics enable algorithms like ChatGPT and agentic AI to deliver better results for customers.

How did Accenture build a strong SMAC practice that has helped it become a stronger AI force?

The answer: a decade-long, aggressive acquisition strategy.

Between September 2014 and August 2024, Accenture spent $23.4 billion, swallowing up 322 companies, according to a Mint review of the company’s press releases and analyst transcripts.

Nearly 90% or 288 of these acquired companies were in the areas of design, SMAC, cybersecurity and AI.

Between September 2014 and August 2024, Accenture spent $23.4 billion, swallowing up 322 companies. In contrast, India’s five largest IT outsourcers collectively spent only $9.5 billion on acquisitions during this period.

In contrast, India’s five largest IT outsourcers collectively spent only $9.5 billion on acquisitions during this period, nearly two and a half times less than what Accenture spent.

Almost all of Accenture’s acquired companies were small in size. It is unclear how the acquired companies are integrated or their solutions taken to market. Regardless, given the nature of its performance, Accenture is challenging the management notion that most buyouts fail.

In a note dated 26 September, CLSA analysts Sumeet Jain and Mridul Goenka stated that Accenture’s rapid scale of acquisitions in 2023-24 helped the company scale up critical areas required to build its Gen AI practice.

“Accenture has spent two decades reinventing itself, from inventing digital in 2013 to ‘Cloud First’ during the pandemic to building a billion-dollar GenAI pipeline in 2022,” said Phil Fersht, chief executive officer of HFS Research, an outsourcing research firm. “That consistency of reinvention, backed by smart acquisitions and deep C-suite access, makes it the pole star for the industry,” he added.

“Most of our (Indian IT’s) acquisitions are done keeping in mind how much revenue a company will generate,” said an executive at TCS who didn’t want to be identified.

Accenture, in contrast, wasn’t buying headcount or existing revenue streams—it was clearly acquiring capability—niche talent and specialized solutions required to build today’s AI infrastructure.

That infrastructure today is a money spinning flywheel.

Last year, Accenture generated $39 billion from cloud services; $20 billion from Accenture Song, its digital advertising business; $10 billion from cybersecurity, and $9 billion from Accenture X, a division that helps manufacturers run their businesses more efficiently.

TCS, Infosys, Wipro and Tech Mahindra ended the last fiscal year with revenue of $30.18 billion, $19.28 billion, $10.51 billion, and $6.26 billion, respectively.

To put the scale in perspective: if Accenture’s individual digital business units operated as separate companies, each would surpass the size of India’s largest, second-largest, and fifth-largest IT services companies, while its cybersecurity unit alone would rival the fourth-largest.

After initially outlining business from some SMAC areas, none of the homegrown IT firms now provide a breakdown of revenue from these segments.

The key to the AI vault

Yet another reason for Accenture gaining such a significant market share in AI is its consulting business, which accounted for over half its revenue.

Mint reported on 29 October 2024 that Accenture and International Business Machines Corp. expanded their Gen AI practice due to the strength of their consulting practices.

“We believe the majority of (Accenture’s) generative AI bookings are in consulting,” said BMO Capital Markets analyst Keith Bachman, Adam J. Holets, Bradley Clark, and Jonathan Stein, in a note dated 25 September.

Indian IT companies, despite years of effort, haven’t succeeded in building sizable consulting practices. Some market watchers ascribe this to how the companies started.

View Full Image

“Accenture’s roots were in consulting. It started with a focus on strategy consulting or management consulting work and later entered the execution layer around technology,” said Ashutosh Sharma, vice-president and research director at Forrester Research.

Indian IT service providers, on the other hand, began with the tech execution layer and then tried building their consulting business. “Some companies, such as Cognizant and Infosys, were able to build reasonably good business consulting services. However, success has been mixed because their approach kept shifting over the last decade due to management churn,” he added.

Expansion, not deflation

Meanwhile, Accenture and Indian IT have diverged in how they perceive AI.

Philosophically, Accenture views AI as an opportunity rather than a risk. Indian IT firms are more cautious. TCS, Cognizant, Infosys and smaller IT firms like Hexaware Technologies have stated that AI could cannibalise some of their current revenue and, in the short term, could be deflationary (result in lower revenue), Mint had reported on 24 September.

“Subdued spending on IT services currently is driven both by AI-led deflation and tariff-led uncertainty,” Nomura analysts Abhishek Bhandari and Karan Nain wrote in a note dated 23 September, after meeting Jatin Dalal, Cognizant’s chief financial officer.

Accenture, however, operates with an expansionary mindset.

“[W]e don’t see AI as deflationary,” said Sweet in a post-earnings call last month, when JP Morgan analyst Tien-Tsin Huang quizzed the management. “We do see and are seeing it as expansionary, similar to every tech evolution we’ve been through,” she added.

Indian providers are often stuck in a capability-centric mindset, said Thomas Reuner, principal analyst at Pierre Audoin Consultants. “They also continue to be challenged by the Indian mid-tier providers, who also invest early in innovation but focus more on micro-specialization.”

The perfect storm

To make matters worse, Indian IT is suffering from an onslaught of internal and external pressure. Some companies are struggling to articulate a cohesive AI strategy. Frequent organisational changes and policy headwinds in the US, its largest export market, have only added to the woes.

Siva Ganesan, who took over as the ‘AI.Cloud’ business head at TCS in July 2023, quit earlier this month, according to two people aware of the matter. His exit followed the appointment of company veteran Amit Kapur to lead its new AI unit. TCS’ AI business, itself, was overhauled at least three times in the past three years.

“TCS does not yet grasp how to drive the new AI operating model and how to get their clients to also go on this journey,” said Peter Bendor-Samuel, founder of Everest Research, a consultancy. “It is clear they (TCS’s management) have lost confidence in their existing leadership in this area and are making changes,” he added.

A questionnaire sent to TCS seeking comment on its AI strategy flip-flop went unanswered.

At Infosys, the company has started to build small AI models, becoming among the first homegrown IT services companies to do so. Such models are trained on smaller data sets and can perform lesser but more specialized functions compared with larger AI tools.

“AI is becoming a compulsory addition in most large deals of the company today, and we are being told to pitch the use of the small AI models that have been developed,” said an Infosys executive on condition of anonymity.

On the policy front, President Donald Trump’s plan for a potential $100,000 H-1B visa fee—a near 100-fold jump—will disproportionately impact Indian firms.

Accenture is cushioned—its management stated that less than 5% of its US workforce is on H-1B visas, unlike Indian IT firms, which rely on the visa for 20-25% of their US workforce, according to analysts at Motilal Oswal.

View Full Image

A second policy challenge arises from outsourcing taxes. On 5 September, Ohio senator Bernie Moreno introduced the Halting International Relocation of Employment (HIRE) Act in the US Senate. The bill aims to impose a 25% tax on payments made to foreign entities for services rendered to US individuals or companies, effective 31 December. Going ahead, this could pose a threat to the outsourcing model itself.

The message, therefore, is clear: the era of scaling on delivery and cost is over.

“Accenture grew through consulting, branding, and acquisitions, while Indian IT scaled on delivery and cost. Copying Accenture is not enough. To win in the AI era, Indian IT must break silos, repay legacy debt, and reinvent as truly integrated services-as-software enterprises,” said Phil Fersht of HFS Research.

Emails sent to Accenture, TCS, Infosys, HCLTech, Wipro, and Tech Mahindra went unanswered.